Ertc Credit 2021 Worksheet

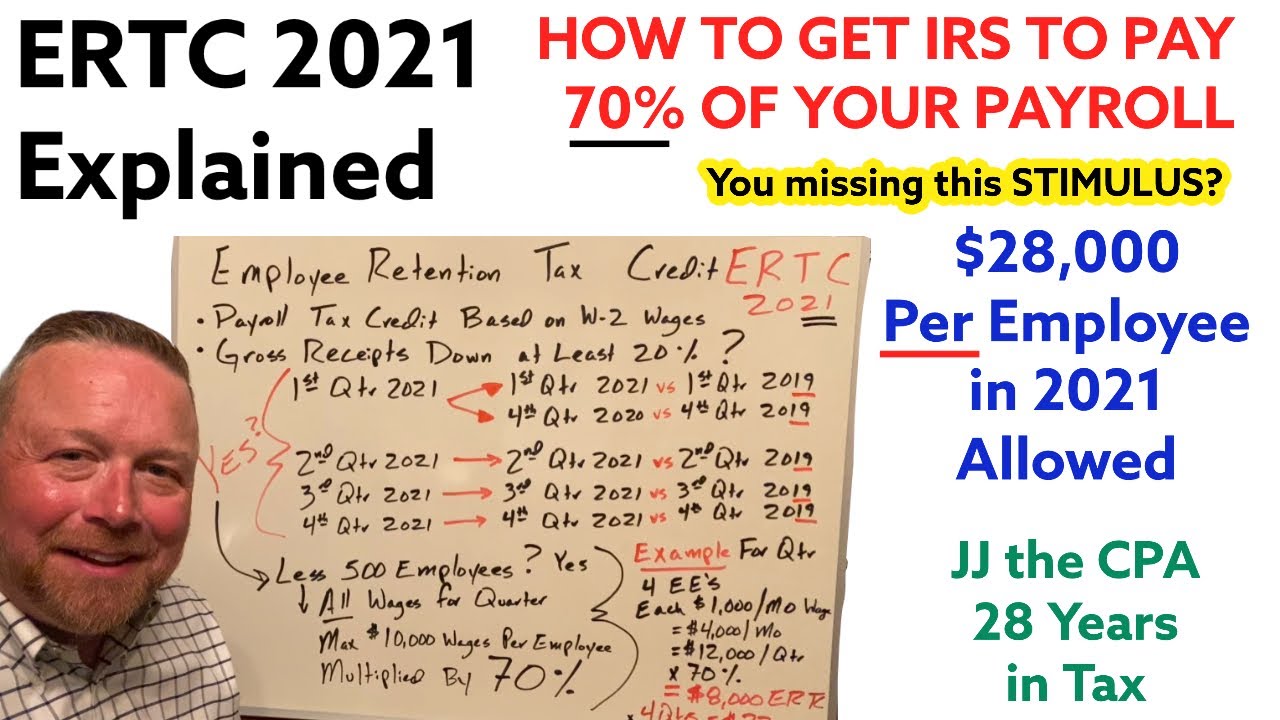

Ertc reference relief quick guide credit employee decision tax retention quarters tree Employee retention credit Employee retention tax credit (ertc): key 2021 updates

How to Obtain the Employee Retention Tax Credit (ERTC) Under the Second

Ertc mp claim answered Employee retention tax credit significantly modified and expanded for Erc 2021: employee retention tax credit explained [understand what is

All about the employee retention tax credit

Quick reference guide for ertc relief: boyer & ritter llcRetention employee ertc obtain How to obtain the employee retention tax credit (ertc) under the secondAre you eligible for the employee retention tax credit?.

Ertc employee retention tax calculate amount eligibilityErtc credit insurance tax pay back payment protection do claim 2021 mp ppi How to claim the ertc: your top 13 questions answeredErtc relief reference quick guide chart credit employee retention tax 2021 tree quarters decision.

Retention tax ertc growthlab

Quick reference guide for ertc relief: boyer & ritter llcEligibility retention flowchart tax erc withum Credit retention employee tax ertc obtain do payroll back table relief covid second round updated under businessHow to obtain the employee retention tax credit (ertc) under the second.

Ertc employee retentionHow to obtain the employee retention tax credit (ertc) under the second Ertc retention obtain round.

Employee Retention Credit - Eligibility and Processing - Update August

How to Obtain the Employee Retention Tax Credit (ERTC) Under the Second

Are you Eligible for the Employee Retention Tax Credit? - jamietrull.com

How to Claim the ERTC: Your Top 13 Questions Answered - MP

Employee Retention Tax Credit (ERTC): Key 2021 Updates - MP

Quick Reference Guide for ERTC Relief: Boyer & Ritter LLC

Quick Reference Guide for ERTC Relief: Boyer & Ritter LLC

How to Obtain the Employee Retention Tax Credit (ERTC) Under the Second

All About the Employee Retention Tax Credit

Employee Retention Tax Credit significantly modified and expanded for